An income statement is one of the most critical financial statements in every accountant’s toolbox.

#Proforma payment pro

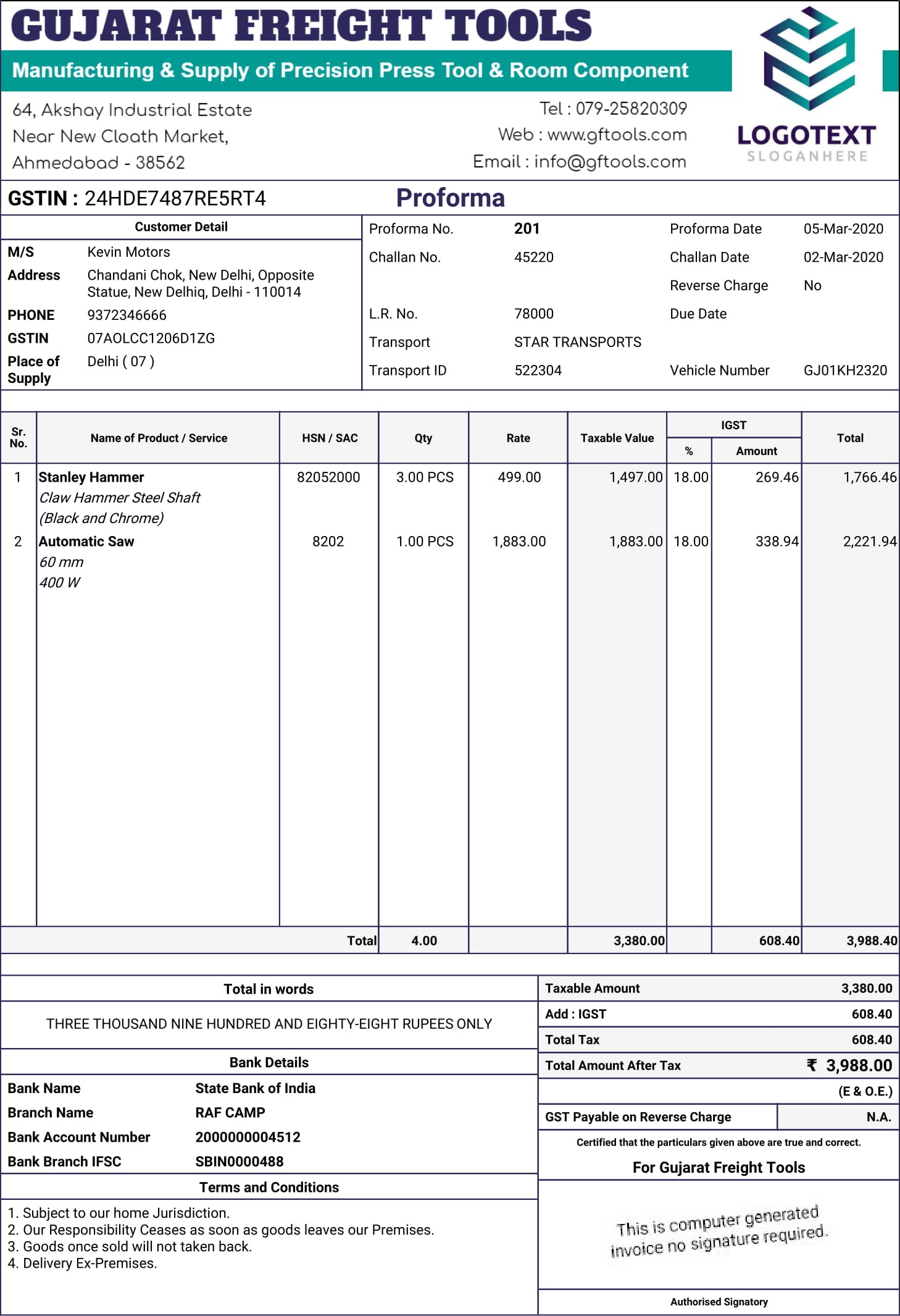

It notes the kind and quantity of goods, their value. There are 3 significant types of pro forma statements: pro forma income statements, pro forma balance sheets, and pro forma cash flow statements. This should hopefully prevent any discord with the customer once the goods are received and the final invoice is sent. A pro-forma invoice is an abridged or estimated invoice sent in advance of a delivery of goods. Everything is agreed up front and in good faith, the customer is clear on what they are receiving and for what cost and the seller knows that the client is happy with the deal. Pro forma invoices are used to try and ensure a smooth sales process. The customer will agree to the price on the pro forma invoice first and then receive the goods.

#Proforma payment plus

The invoice will describe the goods or services being sold and the total amount payable plus any taxes or fees that may be incurred to avoid subjecting the customer to any unexpected charges. Pro forma invoices, which require an advance payment in order to confirm our order, can be issued by companies in.

It can act as an estimate or quotation for the customer but not the final bill for payment. A proforma invoice is a non-legally binding pre invoice that is used to establish the terms of an order before an actual purchase order is sent. In contrast, a proforma invoice estimates the total cost of a transaction or is used to secure payment (or financing) before the goods or services are delivered. It describes the items and terms of sale, but does not serve the function of a real invoice. Here are some critical differences between invoices and proforma invoices: Purpose: An invoice confirms a sale and requests payment. This is because customers aren’t required to pay the amount listed on the proforma, the total amount due isn’t recorded under the customer’s accounts payable or your accounts receivable, and you can’t use a proforma to reclaim VAT.

It provides a provisional bill of sales that is sent after a customer has committed to buying the goods or services but hasn’t yet finalised the details of the sale or received the goods. A proforma invoice is a document provided before or with a shipment of goods. In many ways, a proforma is closer to a quote or estimate than an invoice. Also, it’s important to note that a Proforma Invoice is issued before the goods have been produced or delivered. Pro forma invoices are used to give customers, who are placing an order with a company, an idea of how much the products and services are likely to cost them. Also, it usually includes the seller’s bank details to request payment. Why are pro forma invoices used and when are they sent?

0 kommentar(er)

0 kommentar(er)